EXC – An Update

Posted by mounddweller on July 7, 2011

Fellow Traders,

Last week I posted a message outlining my plan for EXC. You can read that post here: https://troysmoneytree.wordpress.com/2011/07/03/exc-whats-the-plan/. In that message I said I would be watching EXC closely as the JUL options expiration approached on 7/16. Mid-morning today with EXC trading around $43.36 I decided to take action. After weighing my options between rolling to either the OCT $43 or $44 strike I went with the $43. Why, you ask? Well, two reasons. First, while I could have gotten a net credit rolling out to the OCT $44, it would have been small and a significant portion of it would have been chewed up by commissions. Second, while EXC may certainly go higher over the next several days, after looking at the money flow (which is very close to 80), I decided EXC is due to sell-off or at least take a breather. Also, I think the overall market will undergo a serious correction between now and October so I wanted to lock-in the additional premium offered by the $43 strike.

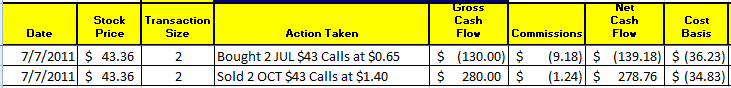

Here are the details for the trade I executed today.

I originally sold the JUL $43 calls back on May 10th at $0.65. So, closing out that trade was essentially a wash. However, by selling the OCT $43 at $1.40 I ended up with a net credit of $0.75. The net effect of all this is I’ll end up with a ROIC of about 3% for a 5 month holding period. Now some folks would say that isn’t too great. But annualized that is about 7.34%. Then, if you add in the 4.94% dividend yield I am getting at my original cost basis of $42.50, you’ll see my annual total ROIC is over 12%.

But wait! It gets even better because my cost basis no longer is $42.50 but is now $34.83. At $34.83 my annualized ROIC is 15%. At that rate I’m doubling my money every 5 years in a boring utility stock!

Regards,

Troy

Leave a comment